Best RD FD MIS Software Development Company

We at Amritaz IT Solutions Pvt. Ltd (AITS) are experienced and expert in RD, FD, MIS and MLM software plan Development. As you already know RD means Recurring Deposit and FD means Fixed Deposit. In FD (Fixed deposit) scheme member need to deposit the money to the company for fixed time period such as one year or two year and after the maturity they will get the amount with interest as per rules and in RD, member deposit particular amount in installment like daily, monthly or on weekly basis as per terms and after it reaches maturity, member gets deposited money with interest. AITS is renowned RD FD MIS Software Development Company based in Varanasi and New Delhi.

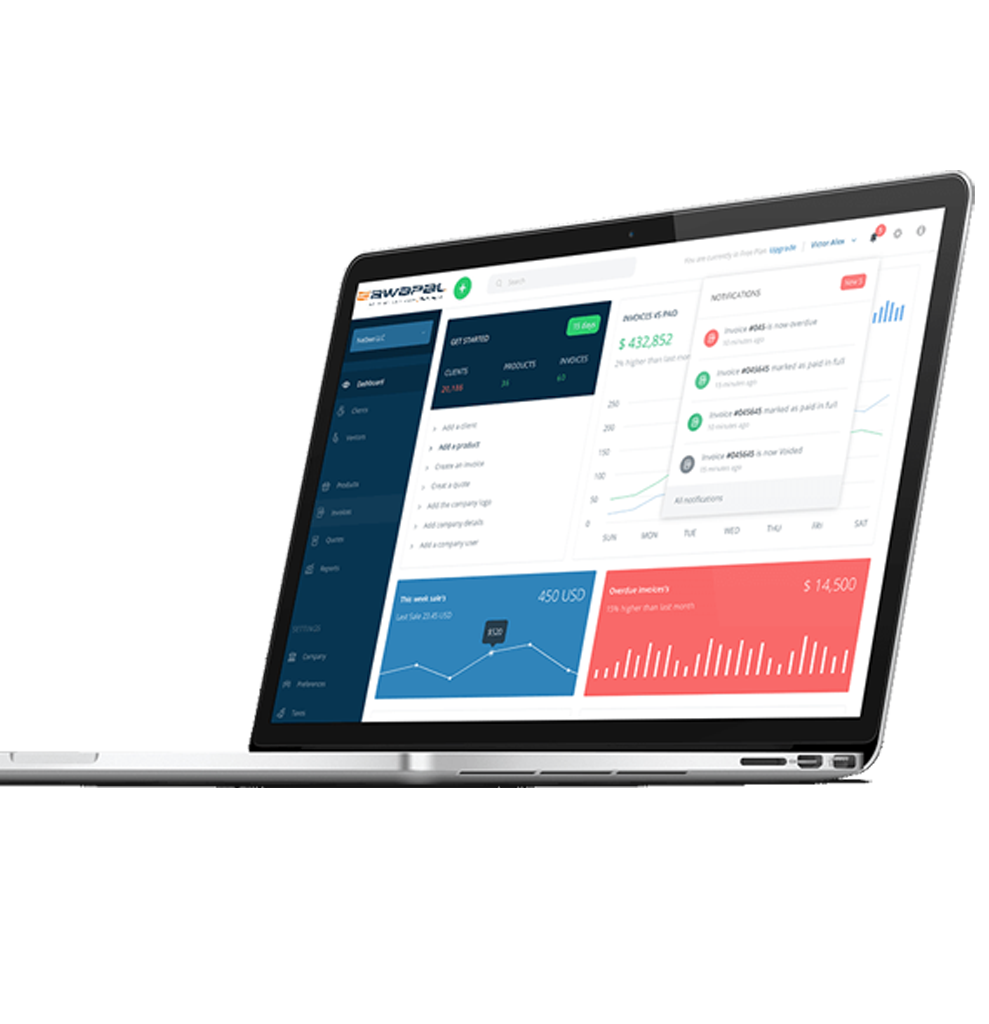

We have developed and customized our software keeping all size of businesses in mind and most required for fresh startups, small business, medium range business as well as or big brands and companies.

Our Software is best fitted and widely used in Mobile shops, Spare Parts retailers, Shoe showrooms, Readymade Garments store, Retail Stores and shopping malls etc.

Features of RD/ FD Plan

- RD / FD scheme reporting

- Penalty calculator

- RD / FD scheme maturity report

- Easy money Deposit Process

- Money Deposit receipt printing

- Report to manage RD / FD scheme

RD FD is a new word in the world of network marketing. As we are quite aware with the concept of multilevel marketing and getting benefits with this short of marketing strategy. Rd-Fd generally refers regular deposit and fixed deposit and this software solution generally belongs credit cooperative society and nidhi limited companies as we are much aware from some of companies that provides us facility to use our fund in better manner where we can save the earning and can get benefit of our amount after investing it for certain duration of time on the behalf of any agreement like property purchase of gold purchase.

For an organization who desires to set the ball rolling with the RD-FD MIS scheme, it will be hard as it will fall flat in managing all the transactions and the calculation of the interest manually. In this regard, they require the RD-FD software plan. It manages all the maturity reports, transnational reports, list of the customers, and installment due report and other types of the reports. With intense human efforts it still does not become feasible. Hence, the assistance of Solver Solutions is pertinent.

So we have the best solution for it and it has been sincerely devoted to the proliferation of its client. It promotes the client at various podiums, which enables the client to reach the zenith.Solver Solutions has the brand professional working for the upgrade of the client.

If you want to start your RD FD MIS Company then you can contact Company Registration Service Prover Company Fundamentals for free assistance.

Some Key Features of the Plan

- The variety offered by these plans is immense and people having different income patterns can easily shortlist one and start investing in one which they feel comfortable.

- Regular small investments on monthly basis or large one-time investments all are possible with these plans.

- The RD-FD-MIS schemes become transparent and reliable with more people trusting these when software is regulating each activity to give perfect money and member management.

- These flexible very beneficial schemes give every person a good investing option with good returns possible depending on the investment.

- A solid one time investing option is given by the FD plan where people make one time investment of their funds to gain huge returns after a set fixed time.

- For a major section of society which earns on monthly basis the MIS plan seems the best choice with a choice to invest or deposit any amount of their choice every month.

We are Expert in

We work on online software development and our products are already in use.

- Banking Software Development

- RD, FD, MIS Software Development

- Nidhi Limited Company Software Development

- Microfinance Limited Software Development

- Multi Level Marketing Software Development

- GST Software Development

- School Management Software Development

- Institute Management Software Development

- e-Commerce Software Development

- e-Education Software Development

RD FD MIS Software Development Company – A Comprehensive Solution for Financial Institutions

In the fast-paced financial sector, banks, credit societies, NBFCs (Non-Banking Financial Companies), and cooperative societies require robust and secure software solutions to manage recurring deposits (RD), fixed deposits (FD), and monthly income schemes (MIS). A professional RD FD MIS Software Development Company plays a crucial role in delivering tailored software solutions that automate financial processes, enhance security, and improve operational efficiency.

What is RD FD MIS Software?

RD FD MIS software is an advanced financial management system designed to handle:

- Recurring Deposits (RD): Automates deposits, maturity calculations, and customer notifications.

- Fixed Deposits (FD): Tracks deposit tenure, interest rates, and premature withdrawal processing.

- Monthly Income Schemes (MIS): Manages monthly payouts, interest calculations, and customer records.

A well-designed RD FD MIS software simplifies deposit management for financial institutions, reducing manual workload and improving accuracy.

Features of RD FD MIS Software

A custom RD FD MIS software comes with numerous features, including:

1. Automated Deposit Management

- Automatic RD, FD, and MIS account creation.

- Interest rate configuration as per institution policies.

- Auto-maturity and reinvestment options.

2. Secure Transactions & Compliance

- End-to-end encryption for financial data security.

- KYC (Know Your Customer) integration.

- RBI & NBFC compliance adherence.

3. Customer Management Module

- Digital onboarding of customers.

- Account statements and transaction history tracking.

- SMS and email notifications for deposits, withdrawals, and maturity alerts.

4. Interest Calculation & Payouts

- Auto-calculation of interest on RD, FD, and MIS schemes.

- Monthly interest payout processing.

- TDS (Tax Deducted at Source) calculation and reporting.

5. Loan Against Deposit

- Option to avail loans against FD and RD.

- Interest rate management for loan accounts.

- Auto-repayment scheduling.

6. Reporting & Analytics

- Real-time financial reports.

- Customer-wise and scheme-wise analytics.

- Exportable reports for auditing and compliance.

Benefits of Using RD FD MIS Software

1. Increased Efficiency

Automating deposit and interest calculations saves time and reduces manual errors.

2. Better Customer Experience

Online access to accounts, real-time notifications, and seamless transactions improve customer satisfaction.

3. Regulatory Compliance

Ensures that financial institutions meet government and banking regulations.

4. Scalability & Customization

Can be customized for small cooperative societies, large NBFCs, or banks as per their unique requirements.

Why Choose a Professional RD FD MIS Software Development Company?

A reputed RD FD MIS software development company offers:

- Custom Software Development tailored to specific financial needs.

- Cloud-Based & On-Premises Solutions for flexibility and security.

- Integration with Banking APIs for seamless transactions.

- 24/7 Support & Maintenance for uninterrupted service.